BNY Mellon Benefits Guide

Cost of Coverage

How the Plans Work

Familiar Features

Plan HRA (Health Reimbursement Account) and Plan HSA (Health Savings Account) are both built on traditional health insurance plans with these features:

- You have access to national networks of doctors and hospitals provided by Aetna or UnitedHealthcare.

- You save through negotiated discounts when care is received in-network, while retaining the freedom to use out-of-network providers at a higher cost.

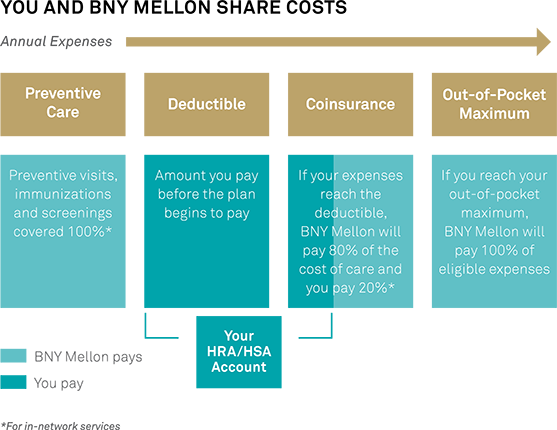

- After you reach your annual deductible, BNY Mellon pays 80 percent of the cost of most other care, and you pay 20 percent for in-network providers.

- Your out-of-pocket medical costs are limited to an annual maximum — including your deductible and coinsurance — which is the most you will pay in any year.

- Prescription coverage is provided through CVS Caremark with negotiated discounts.

- Preventive care is covered at 100 percent if you use in-network providers.

Higher Deductible

Both health plan options have a higher deductible than traditional health plans. High-deductible plans make it more important for you to figure out the price and value of medical services, with the aid of your physician and the price and quality comparison tools provided by your medical carrier. Some medical services are so important and so valuable that you and your physician will agree they should be obtained. You may find that other services have equally effective but less costly alternatives. Asking questions about quality, price and value can help you manage costs without sacrificing quality of care.

The Health Accounts

Whether you choose the Plan HSA or Plan HRA with Aetna or UnitedHealthcare, you'll have access to a personal health account. BNY Mellon will contribute to these accounts on or before your first pay following your plan effective date, to help you pay your share of eligible health care expenses. These health accounts reward you for effective long-term health care savings, even into retirement, because unused balances generally roll forward from year to year.

- A Health Reimbursement Account will be automatically opened for you if you newly enroll in Plan HRA. BNY Mellon contributes to your health account to help you pay your portion of eligible health care expenses.

- A Health Savings Account, regulated by IRS rules, will be automatically opened for you if you newly enroll in Plan HSA. BNY Mellon contributes to your health account to help you pay your portion of eligible health care expenses. In addition, from your pay, you can also contribute pre-tax dollars to your health account up to the annual IRS limits (Individual annual maximum: $3,350; Employee + Child(ren), Employee + Spouse/Domestic Partner or Employee + Family annual maximum: $6,750; Age 55 or older: additional catch-up contributions of up to $1,000 annually). Health account earnings and distributions (for eligible expenses) are also tax-free.

- Your contributions to pay for your health coverage are paid on a "tax-free" basis. As used throughout this guide, "tax-free" means they are generally exempt from federal income and Social Security taxes, as well as many state income taxes.

- The amount BNY Mellon contributes on your behalf to either account is based upon your coverage level and your base pay. As used in this guide, "base pay" generally means your annualized base pay, or rate of pay based on a normal workweek not exceeding 40 hours, generally excluding commissions, overtime pay, bonuses, payments in lieu of vacation, all non-regular payments and any other special purpose payments. Salary reduction contributions, Code Section 132(f) transportation plan and similar salary reduction, as well as any deferred compensation contributions, are included in your base pay. In the event of any discrepancy between this information and the applicable plan documents, the terms of the applicable plan documents will apply.

Account Basics

- If you newly enroll in Plan HRA or Plan HSA, your health account will be opened on January 1, 2016, or your plan effective date.

- If you newly elect Plan HSA, you will be presented with the BenefitWallet HSA terms and conditions after you enroll. Once you agree to the terms and conditions, your electronic signature will be used to activate your HSA on your plan effective date.

- BNY Mellon will contribute to either your HRA or HSA in one lump sum on or before your first pay following your plan effective date. The BNY Mellon contribution deposited to your health account will be based on your base pay level.

- In addition to receiving BNY Mellon's contribution, you can also make pre-tax contributions to your HSA, up to the annual IRS limits (see "Plan HSA (Health Savings Account)" for more information). HSA contributions can only be used for qualified health care expenses, and contributions cannot be withdrawn from your health account to pay non-health-related expenses.

- You decide when to use your health account to pay for qualified health care expenses.

- Participation in the HSA is subject to IRS rules, including limits on other existing health care coverage and certain restrictions that may apply to adult dependents up to age 26.

- Unused balances roll forward from year to year.

- HSA contributions belong to you. If you leave BNY Mellon for any reason and at any age, HSA contributions remaining in your health account will continue to be available for your use.

- HRA contributions remaining in your health account will remain available for your use if you leave BNY Mellon at or following the attainment of age 55, but will be forfeited if you leave BNY Mellon prior to attaining age 55.

Important: If you are currently enrolled in Medicare or Tricare, you may participate in Plan HSA but you may not contribute to a Health Savings Account. See "Health Savings Account (HSA) Contributions" for more information about IRS regulations on Health Savings Accounts.

You and BNY Mellon Share Costs

Both health accounts help you budget and save for your share of health care costs — like deductibles and coinsurance.

Cost of Coverage

Your cost of coverage, or your per-pay cost, is what you pay for medical coverage whether or not you use medical services. It is important to consider both your cost of coverage and your cost of care (i.e., deductible, coinsurance and out-of-pocket maximum) when comparing your health plan options. Review the "2016 Monthly Medical Contributions."

Make sure your current health plan election still meets your needs for 2016. See "Tools to Help You Choose the Right Health Plan" in the Welcome to Open Enrollment 2016 section for interactive tools you can use to compare options more carefully.

|

PLAN HRA (HEALTH REIMBURSEMENT ACCOUNT) MAY BE RIGHT FOR YOU IF YOU . . .

|

PLAN HSA (HEALTH SAVINGS ACCOUNT) MAY BE RIGHT FOR YOU IF YOU . . .

|

* Under Plan HRA, individual deductibles apply to each family member until the family deductible is met. Under Plan HSA, if an employee elects coverage for dependents, the "true family" deductible must be met before the Plan reimburses for benefits, even if only one family member incurs expenses.

Precertification

You are required to contact Aetna or UnitedHealthcare before a planned inpatient admission or within 48 hours of an emergency admission. If you don't call, and it is later determined that all or part of your stay was not medically necessary or appropriate, you will be responsible for payment of any costs not covered.

Coverage Includes Mastectomy Benefits

Under the Women's Health and Cancer Rights Act (WHCRA), mastectomy benefits must cover certain reconstructive surgery. For individuals receiving mastectomy-related benefits, coverage will be provided in a manner determined in consultation with the attending physician and the patient for:

- all stages of reconstruction of the breast on which a mastectomy has been performed;

- surgery and reconstruction of the other breast to produce a symmetrical appearance;

- the cost of prostheses; and

- the costs of treatment of physical complications at any stage of the mastectomy, including lymphedemas.

These benefits will be provided subject to the same deductibles and coinsurance applicable to other medical and surgical benefits provided under this plan. For more information on mastectomy benefits, call your health plan carrier.

Healthy Pregnancy Programs

If you are an expectant mother covered under Plan HRA or Plan HSA and you complete either Aetna's or UnitedHealthcare's Healthy Pregnancy program (depending on the BNY Mellon health plan carrier you select) by July 31, 2016, you may earn a $150 Live Well incentive. Visit www.livewell.bnymellon.com for more information about the incentive and requirements.

Aetna's Beginning Right Maternity Program

If you are an expectant mother or father, you can participate in the Beginning Right Maternity Program when you enroll in a health plan through Aetna. Use the program throughout your pregnancy and even after your baby is born. You'll receive:

- Information for a healthier pregnancy, including prenatal care, preterm labor symptoms, what to expect before and after delivery, newborn care and more.

- Special help for pregnancy risks. Some individuals have health conditions or other risk factors that could affect their pregnancy. If you do, you can work with a nurse case manager to help you lower those risks. If you're eligible, you also receive follow-up calls after your delivery, a screening for depression and extra support, if needed.

- Support to quit smoking. If you aren't smoking — wonderful! If you are, you'll lower your baby's risk for preterm delivery, low birth weight and sudden infant death syndrome (SIDS) by quitting. You're not in it alone. With the Beginning Right Smoke-Free Moms-to-Be® Program, you'll receive one-on-one nurse support to help you quit smoking for good.

- Counseling on lowering preterm labor risks. Some babies are born much sooner than expected. This can raise the risk for complications. If you're at risk of preterm labor, the Beginning Right Maternity Program can teach you the signs and symptoms of early labor. You'll also hear about new treatment options.

To enroll in the Beginning Right Maternity Program, call Aetna toll-free at 1-800-CRADLE-1 (1-800-272-3531), weekdays from 8 a.m. to 7 p.m. Eastern Time, or log in to the Aetna Navigator at www.aetna.com and look under Health Programs.

You can also visit Aetna Women's Health at www.womenshealth.aetna.com to learn about pregnancy and other women's health-related information, including reproductive health, menopause, depression, breast and heart health, baby care and more.

UnitedHealthcare Maternity Support Program

If you are enrolled in a UnitedHealthcare health plan and are pregnant or thinking about becoming pregnant, you can get valuable educational information, advice and comprehensive case management.

This program offers:

- enrollment by an OB nurse assigned to you;

- preconception health coaching;

- written and online educational resources covering a wide range of topics;

- first and second trimester risk screenings;

- identification and management of at-risk or high-risk conditions that may impact pregnancy;

- predelivery consultation;

- coordination with, and referrals to, other benefits and programs available under the health plan;

- a phone call from a nurse approximately two weeks after the birth of your child to provide information on postpartum and newborn care, feeding, nutrition, immunizations and more; and

- postpartum depression screening.

Participation is completely voluntary and at no extra charge. To take full advantage of the program, mothers and fathers are encouraged to enroll within the first trimester of pregnancy. You can enroll anytime, up to the 34th week of pregnancy.

To enroll in the UnitedHealthcare Maternity Support Program, call 1-800-842-0750.

Infertility Services

If you are dealing with an infertility issue, get the support you need to help you determine the course of action for diagnosis and treatment that best meets your needs by contacting your Aetna or UnitedHealthcare Health Advantage nurse. Before receiving treatment, you'll receive education and guidance with the help of specialized nurse consultants who work with you throughout the diagnostic and treatment process. These services also include access to infertility treatment providers through their Centers of Excellence (COE) network clinics. These facilities have passed the best practice evaluation criteria, developed by Aetna's and UnitedHealthcare's oversight and advisory committees of practicing clinical experts. The rigorous quality control metrics include high pregnancy rates, reduced risk of multiple births, and exceptional facility operations and staffing.

Starting January 1, 2016, Aetna and UnitedHealthcare will cover infertility services only when the services are pre-authorized and you receive services at a COE. As authorized by your carrier, individuals in a current cycle of infertility treatment as of January 1, 2016, will have benefits paid for the current cycle, regardless of where the services are provided. After the current cycle is completed, if a COE is available, benefits will be paid only if the COE is used. If a COE is not available, approved treatment will be covered. The lifetime maximum benefits for medical services related to infertility services will increase to $25,000; the lifetime maximum benefits for prescription drugs related to infertility services remains at $10,000.

Autism Spectrum Disorder Services

Starting January 1, 2016, Aetna and UnitedHealthcare will cover the following services for individuals who have been diagnosed with autism spectrum disorder, whether provided on an outpatient or inpatient basis:

- Medically necessary diagnostic evaluations and assessment;

- Medication management;

- Individual, family, therapeutic group and provider-based case management services;

- Crisis intervention;

- Medically necessary partial hospitalization/day treatment;

- Medically necessary services at a residential treatment facility; and

- Medically necessary intensive outpatient treatment.

Applied Behavior Analysis Therapy

ABA is a service that uses intensive behavioral and educational therapies that:

Prior authorization is required under both Aetna and UnitedHealthcare for ABA benefits, and services may be subject to ongoing reviews and authorization. To begin the authorization process, contact your health plan carrier.